Understanding Crypto Volatility: WeedCoin’s Guide to Staying Calm

Crypto moves fast — but you don’t have to panic. Learn to ride the waves.

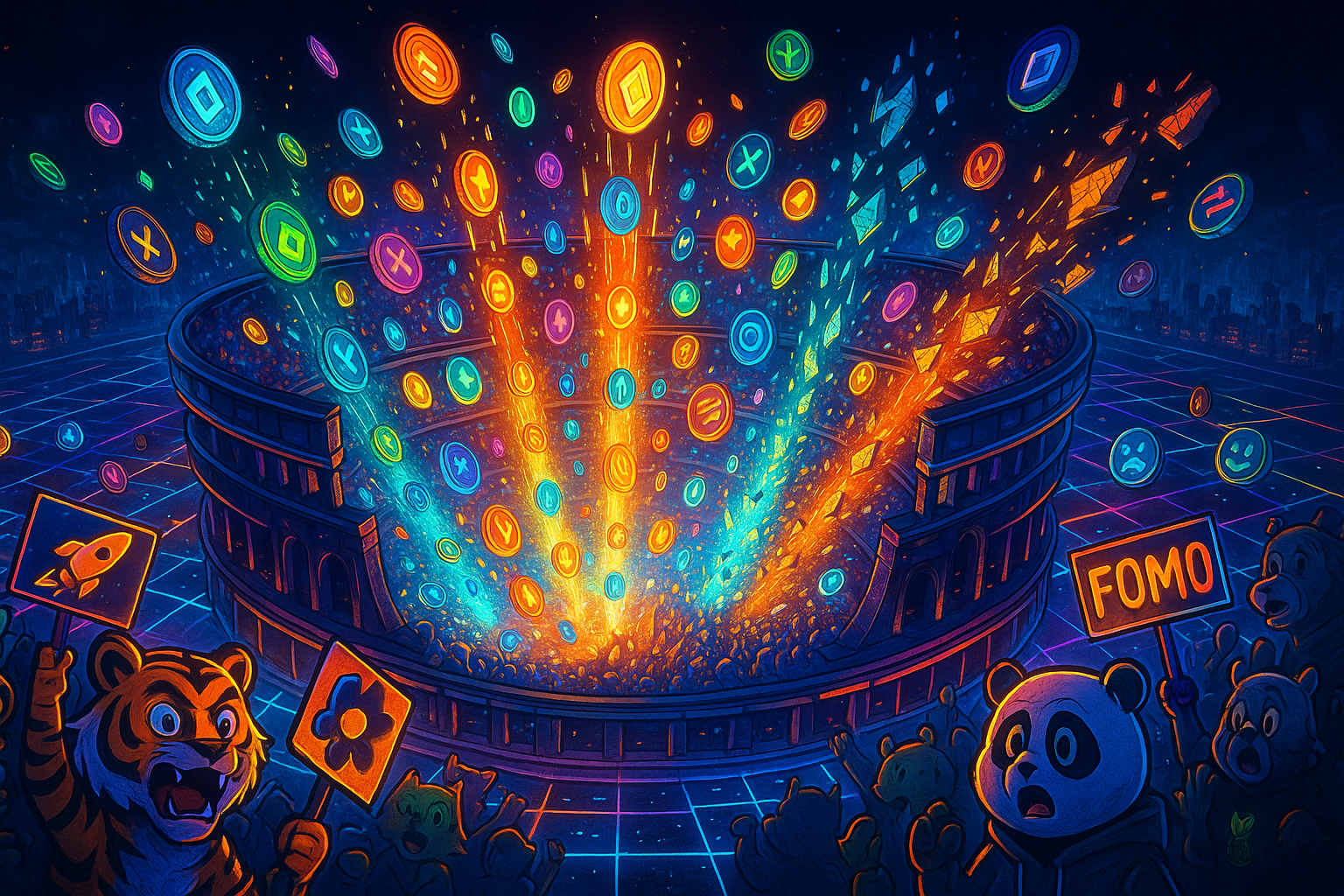

Volatility is part of what makes crypto exciting — and intimidating. Prices can surge or crash in a matter of hours. One tweet, trend, or piece of news can send the entire market into a frenzy. But volatility isn’t random chaos — it’s energy. And if you understand how to read it, you can use it to your advantage.

In this article, we’ll break down what volatility means in crypto, what causes it, and how WeedCoin helps users navigate the ups and downs without losing their cool — or their tokens.

What Is Volatility, Really?

Volatility is a measure of how much an asset’s price moves over time. A highly volatile coin might double in a day — or drop just as fast. It doesn’t mean the asset is bad. It just means it reacts quickly to changes in demand, sentiment, and news.

Crypto is naturally more volatile than traditional markets because it’s still young, global, and mostly unregulated. For traders, volatility = opportunity. For investors, it’s a test of patience.

What Causes Price Swings?

Crypto volatility is fueled by a mix of factors: news events, social media hype, global politics, whale moves (large transactions), and even meme momentum. A sudden surge in tweets or TikToks about a coin can pump the price — but it can also fade just as fast.

WeedCoin experiences these waves too. As a culture-driven token, it reacts to moments in cannabis, crypto, and meme culture. Understanding what’s hype vs. what’s value is part of the game.

Don’t Chase Pumps, Don’t Fear Dips

When prices spike, it’s tempting to FOMO in. When they crash, it’s tempting to panic-sell. But these emotional reactions often lead to losses. Instead, smart users create a strategy — and stick to it.

WeedCoin teaches users to zoom out. Short-term moves don’t define long-term value. Just like good bud, the best results come with patience and clarity.

Volatility = Energy (Use It Right)

Volatility isn’t just a threat — it’s a tool. Traders can use it to flip profits. Investors can use it to buy dips. The key is knowing your goal, having a plan, and not letting fear or greed run the show.

WeedCoin’s educational content is built to help you build that plan — and the community is here to help you stay grounded when things get wild.

Volatility Feeds Community Coins

Coins like WeedCoin thrive in volatile environments because they have strong communities to catch the fall and fuel the climb. We’re not just trading hype — we’re building culture. And that keeps us moving, even when the charts wobble.

Volatility doesn’t scare us. It energizes us.

Practical Tips

Don’t panic during dips — zoom out and review your goals

Avoid FOMO buying at the top — wait for confirmation

Set stop-loss or take-profit levels to manage risk

Use volatility to your advantage — buy dips, take profits on pumps

Join communities like WeedCoin to get insights during market chaos

Key Takeaways

Volatility means rapid price movement — up and down

Crypto is volatile by nature — but that creates opportunity

WeedCoin reacts to trends but stays rooted in real-world culture

Emotional decisions hurt more than market swings

A solid plan beats hype every time

The market may swing — but your strategy shouldn’t.

WeedCoin helps you ride the waves with confidence, clarity, and culture.