Understanding Meme Coin Market Behavior with Weedcoin

They don’t follow the charts — they create them.

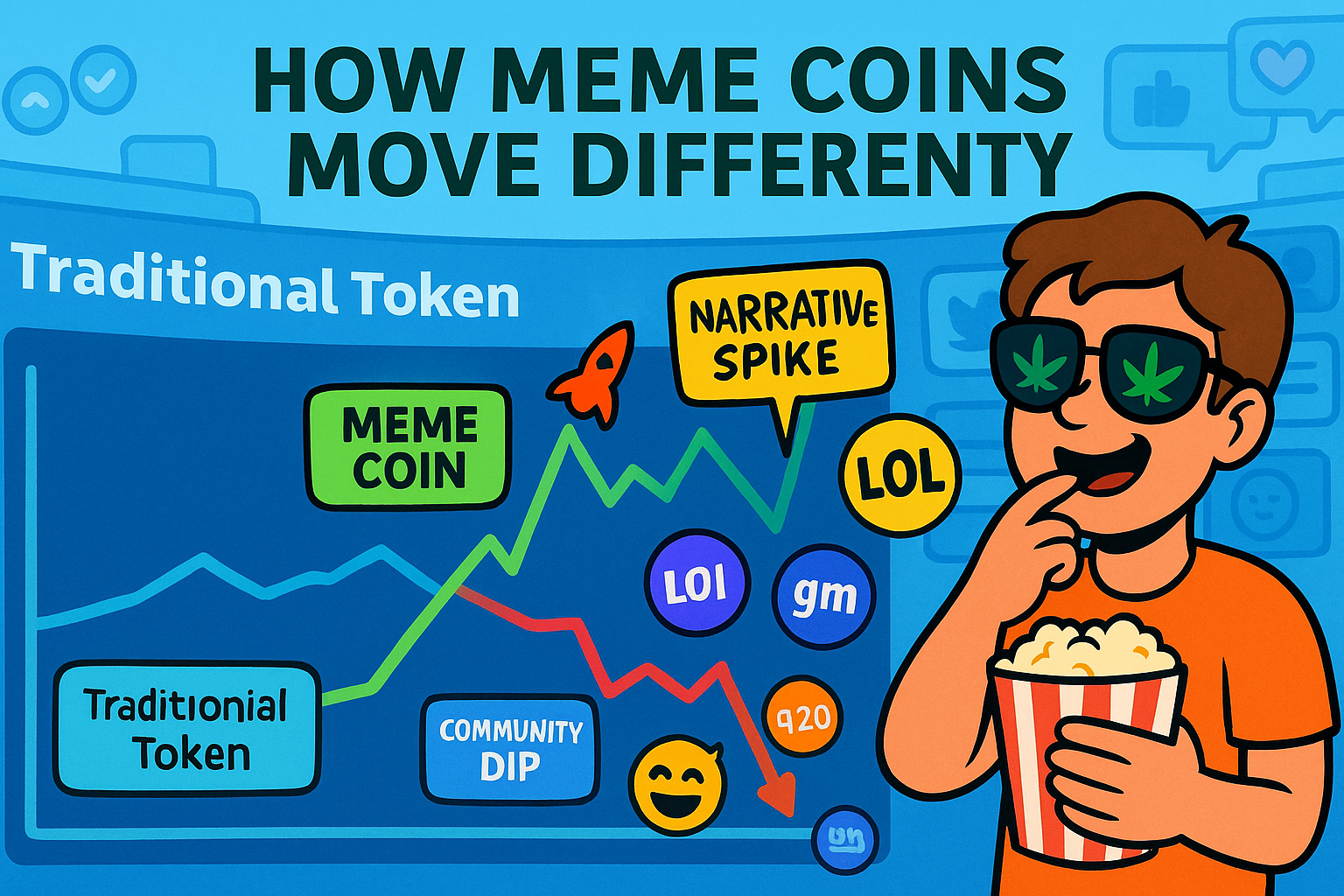

Meme coins move differently than traditional tokens. From explosive launches to viral dips and unpredictable rebounds, here’s what drives their market behavior — and why understanding it can give you an edge in the culture economy.

Meme coins aren’t like your average blue-chip crypto. They don’t pretend to be boring. They don’t play by institutional rules. And they don’t wait for permission to pump. Instead, they move on vibes, virality, and velocity — three forces that make them thrilling, volatile, and full of unexpected potential.

At Weedcoin, we embrace that chaos — and we help you learn how to read it. Because understanding meme coin behavior isn’t just about knowing when to buy. It’s about knowing how culture drives price.

The “Hype Launch” pattern

Most meme coins start fast. Really fast. The moment they go live, they’re picked up by communities, trend watchers, and crypto degens hunting for the next moonshot. If the branding hits, the meme is strong, and the early holders post loud — it triggers a hype spike.

But what comes next is just as important: the inevitable post-hype drop. This isn’t a crash — it’s a cooldown. And smart meme coins (like Weedcoin) use this phase to build actual community utility, education, and culture, setting the stage for the next rally.

Volatility is the feature — not a flaw

Meme coins are supposed to swing. They’re powered by momentum, sentiment, and storylines, not just market mechanics. That’s why they can 10x in a day — or retrace just as fast.

But that volatility has a purpose. It lets new holders get in. It rewards attention. And it creates constant opportunities for engagement.

At Weedcoin, we teach you how to navigate those swings with community education, transparent development, and tools that turn FOMO into informed participation.

Narrative drives price action

Unlike traditional crypto, meme coins don’t need product launches to move. They need memes. A single viral tweet, a trending TikTok, a Discord thread, or a media mention can cause surges that defy charts.

It’s not just about technicals — it’s about timing, tone, and tribal energy. That’s why the Meme Joint and Weedcoin content ecosystem exist: to build and fuel that narrative loop intentionally.

Liquidity follows the laughs

You want more volume? Make more memes. Meme coins attract traders, sure — but they keep communities when the culture is strong.

When people believe in the joke and the mission, they stick around. And that sustained engagement creates healthier liquidity, fewer paper hands, and longer-lasting holders.

Weedcoin is proof: culture-first tokens survive the noise.

Meme coins are macro mood indicators

When meme coins start moving across the board, it’s often a sign that crypto is heating up as a whole. They’re the smoke signals of sentiment — early indicators that retail interest is rising.

So when you see WeedCoincoin trending, it’s not just a moment. It might be a signal.

Practical Tips

- Don’t panic when meme coins dip — it’s part of the pattern.

- Track the meme narrative, not just the market cap.

- Engage in the culture — memes create momentum that charts can’t predict.

- Look for projects (like Weedcoin) that build beyond the meme.

- Use volatility as a learning opportunity, not a reason to exit.

Key Takeaways

- Meme coins like Weedcoin behave differently than traditional tokens.

- They rise on hype, fall on fatigue, and rise again with narrative strength.

- Community energy, content, and timing drive more value than tech alone.

- Volatility is expected — and can be leveraged with the right mindset.

- Understanding market behavior starts by understanding meme culture.

Meme coins don’t just react to the market — they shape it. They reflect energy, attitude, and alignment with the moment. And in the case of Weedcoin, they turn every chart swing into an educational opportunity. Don’t just chase the pump — understand the pattern.